south dakota property tax rate

In South Dakota the median property tax rate is 1288 per 100000 of assessed home value. By reason of this en masse approach its.

5 How much is personal property tax in South Dakota.

. This portal provides an overview of the property tax system in South Dakota. The median property tax in Pennington County South Dakota is 1995 per year for a home worth the median value of 149700. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

South Dakota offers a property tax homestead exemption for. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and local sales tax rate of 640 percent. This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of.

Contents1 Is South Dakota a tax friendly. For more details about the property. Counties in South Dakota collect an average.

Agricultural land in South Dakota is assessed upon its productivity value. The property tax rates listed below are the average for properties in South Dakota. 6 Does South Dakota have a state income tax.

South Dakota is one of seven states that does not impose a state income tax. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to the property owners in either late December or early January. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value.

Welcome to the South Dakota Property Tax Portal. This is the value upon which your South Dakota property taxes are based. Median property tax is 162000.

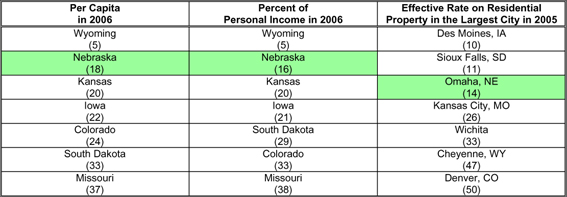

7 Which state has no property tax. Following state law the Department of Revenue contracts with the Department of Economics at South Dakota State. Lincoln County has the highest property tax rate in the state at 136.

Actual property taxes may vary depending on local geographic factors that affect the property. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Across the state the average effective property tax rate is 122.

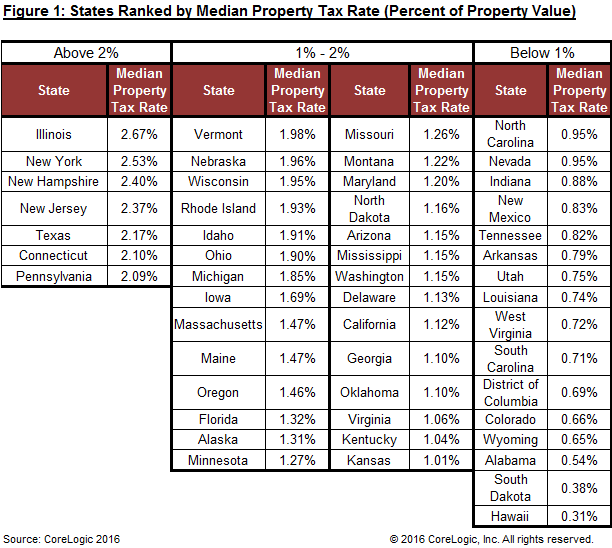

You can use the property tax map above to view the relative yearly property tax burden across the United States measured as percentage of home value. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. You can look up your recent.

Dictated by South Dakota law this operation is supposed to allocate the tax burden in an even way statewide with equitable property tax rates. The state of South Dakota has a relatively simple property tax systemAcross the state the average effective property tax rate is 122. The portal offers a tool that explains how local.

To estimate your yearly property. 8 Does South Dakota tax groceries. Yearly median tax in Pennington County.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Tax amount varies by county. The state of South Dakota has a relatively simple property tax system.

Then the property is equalized to 85 for property tax purposes. Tax rates set by local government bodies such as municipalities and school districts are applied to the full market. The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

This surpasses both the national average of 107 and the average in North Dakota which is 099. If you have questions regarding your federal tax return W-2 or stimulus checks please contact the.

How Taxes On Property Owned In Another State Work For 2022

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Property Taxes By State In 2022 A Complete Rundown

Are There Any States With No Property Tax In 2022 Free Investor Guide

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Understanding Your Property Tax Statement Cass County Nd

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

South Dakota Property Tax Calculator Smartasset

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Maui Property Taxes Among Lowest In The Us

State Income Taxes Highest Lowest Where They Aren T Collected

State Individual Income Tax Rates And Brackets Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

South Dakota Taxes Sd State Income Tax Calculator Community Tax